Thursday, January 16, 2025

Discover the key differences between CSRD and EUDR deforestation requirements for cocoa. Learn how to align traceability, reporting, and compliance efforts to meet EU sustainability standards.

Maikel Fontein

Jan 16, 2025

7

min

CSRD vs. EUDR: Navigating Deforestation Requirements for Cocoa Commodity Players

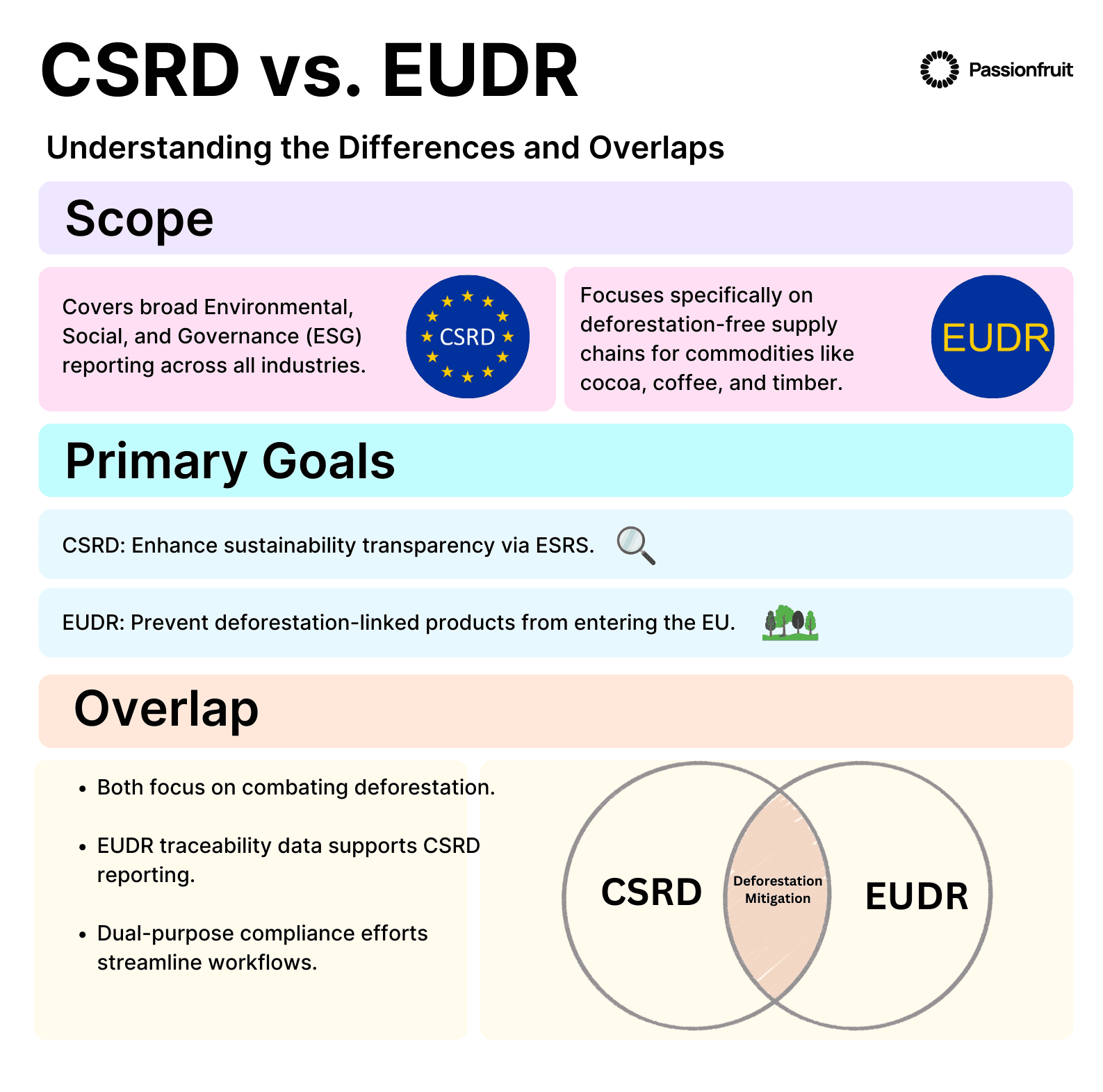

The European Union has set ambitious environmental goals, driving the introduction of sustainability regulations that affect many industries, including the cocoa sector. Among the most significant of these regulations are the Corporate Sustainability Reporting Directive (CSRD) and the EU Deforestation Regulation (EUDR). While these two frameworks overlap in areas like deforestation, they serve distinct functions. Understanding how they interact—and where they diverge—is crucial for coffee commodity players, particularly private label brands and retailers, who often face unique challenges such as managing diverse supplier bases and ensuring consistent sustainability standards across a wide range of products. Streamlining compliance efforts is critical for these players to maintain their market presence and meet growing consumer and regulatory expectations.

This blog dives deep into the differences and interconnections between the CSRD and EUDR, offering actionable steps to align with both and highlighting strategies for optimizing compliance workflows.

Overview of CSRD and EUDR

Corporate Sustainability Reporting Directive (CSRD)

The CSRD, effective from 2024, is a landmark regulation aimed at enhancing corporate transparency across environmental, social, and governance (ESG) factors. This regulation broadens the scope of the previous Non-Financial Reporting Directive (NFRD) by requiring large companies and non-EU companies with substantial EU operations to disclose their sustainability impacts in line with the European Sustainability Reporting Standards (ESRS).

For cacao commodity players, CSRD introduces specific reporting obligations related to deforestation:

Transition Plan for Biodiversity and Ecosystems (E4-1):

Companies need to explain how their business affects nature, especially wildlife and ecosystems. They should look at risks like climate change or deforestation and how these could hurt biodiversity. Companies need to describe which parts of their business and supply chain are at risk and how they’re preparing for these changes. They also need to show how they involve local communities, especially those with traditional knowledge. For example, a cocoa company might work with local farmers to use farming methods that protect nature, like planting trees alongside cocoa plants, to ensure the land stays healthy and productive.

Policies Related to Biodiversity and Ecosystems (E4-2):

Companies need to share the rules they follow to protect biodiversity. This includes making sure they source cocoa beans from farms that don’t harm the environment, like by cutting down rainforests. They should also track where their cocoa comes from to ensure it’s sustainably grown. For instance, a cocoa company might have a policy to only buy beans from farms that use responsible farming practices and can prove their beans don’t come from illegal deforestation areas.

Actions and Resources Dedicated to Biodiversity and Ecosystems (E4-3):

Companies must show the actions they take to protect biodiversity and how they’re investing in these efforts. This includes reducing harm to the environment, restoring ecosystems, and helping wildlife. They should also support local and indigenous communities. For example, a cocoa company might invest in planting trees in areas impacted by cocoa farming and work with local communities to restore land and protect wildlife habitats.

Targets Related to Biodiversity and Ecosystems (E4-4):

Companies must set clear goals to protect nature and show how they plan to meet them. They should explain what areas these goals cover and how they relate to their cocoa farming practices. For example, a cocoa company might set a goal to reduce deforestation in cocoa-growing regions and restore ecosystems. They could commit to planting a certain number of trees in areas where cocoa farming has harmed the environment.

Impact Metrics Tracking Biodiversity and Ecosystem Change (E4-5):

Companies need to track how their business affects biodiversity and ecosystems. This includes monitoring sensitive areas like rainforests and tracking how their activities affect species and their habitats. For example, a cocoa company might monitor how cocoa farming affects local bird species, checking if their numbers are decreasing or if their habitat is being harmed.

Anticipated Financial Effects from Material Biodiversity and Ecosystem-Related Risks and Opportunities (E4-6):

Companies should look at how their actions, good or bad, will affect their finances. This could mean costs for harming the environment or benefits from sustainable practices, like selling cocoa at a premium price. For example, a cocoa company might face penalties for deforestation or see lower crop yields if their farming methods are unsustainable. But, by using sustainable practices, they could increase yields and access higher-paying markets that value environmentally friendly products.

EU Deforestation Regulation (EUDR)

The EUDR, adopted in 2023, takes a more targeted approach to sustainability, specifically addressing deforestation linked to certain commodities like coffee. Unlike CSRD, which focuses on reporting and disclosure, the EUDR demands actionable steps to ensure that coffee products entering the EU market are not linked to deforestation or forest degradation.

Key aspects of the EUDR:

Traceability: Cocoa must be traceable, meaning companies need to know exactly where their cocoa comes from. They must have proof (like geolocation data) showing the cocoa was grown on land that hasn’t been deforested after December 31, 2020.

No Deforestation: Cocoa must not be sourced from land that has been cleared (deforested) after December 31, 2020. This rule aims to stop the destruction of forests for cocoa farming and other agricultural uses.

Due Diligence: Companies must check and assess the risk of deforestation in their supply chains and take steps to reduce those risks. This means companies need to make sure their suppliers (farmers and producers) are following these rules too. If they find any risks of deforestation, companies must take action to address them, such as by helping farmers use more sustainable practices or choosing different sources of cocoa that don’t harm forests.

Scope: The EUDR applies to all cocoa imports into the EU. This means if a cocoa company wants to sell in the EU, they must follow the rules, even if their cocoa is grown outside the EU. Companies that don’t follow the rules risk losing access to the EU market, which could hurt their sales and reputation.

Mandatory compliance with the EUDR starts in 2025. Companies that fail to meet the requirements by this deadline could face fines or lose the right to sell their cocoa in the EU market.

How CSRD and EUDR Interconnect: A Deep Dive

Shared Deforestation Focus: Both CSRD and EUDR address deforestation, with CSRD focusing on disclosing strategies to mitigate it, while EUDR mandates actionable steps like farm-level traceability; for example, a cocoa company’s compliance with EUDR geolocation requirements directly supports CSRD disclosures on deforestation mitigation.

Complementary Reporting and Traceability: EUDR requires businesses to collect GPS data to ensure deforestation-free sourcing, which can be directly used for CSRD’s ESRS E4-3 reporting on sustainable sourcing, making traceability data from EUDR helpful for CSRD disclosures on actions and resources dedicated to biodiversity and ecosystems.

Due Diligence Alignment: The EUDR’s due diligence requirements, like risk assessments and mitigation plans, align with CSRD’s E4-2 requirement to disclose actions taken to reduce deforestation risks, allowing businesses to use certifications and due diligence work done for EUDR compliance to fulfill their CSRD reporting obligations.

1. Build Comprehensive Traceability Systems

Geospatial Monitoring:

To meet the EUDR's traceability requirements, cocoa companies must track the geographical origin of their cocoa. Using tools like Global Forest Watch or Satelligence, cocoa businesses can monitor deforestation risks in sourcing regions. These platforms provide real-time data on land-use changes, helping companies track whether cocoa is being sourced from within the EUDR lines.

Example: Cocoa companies can map their supply chains to ensure that the farms they source from comply with the EUDR’s deforestation-free mandate. By using GPS data, they can confirm that cocoa comes from regions that haven't been deforested after the regulatory deadline.

Centralized Data:

Maintaining a centralized database that includes supplier information, certifications, and geolocation data is essential. By consolidating this data in one location, businesses can efficiently cross-reference supplier compliance with both EUDR and CSRD requirements, reducing redundancy in documentation and minimizing the risk of oversight. Centralized databases also enable seamless updates and real-time tracking, which are critical for meeting stringent traceability and reporting standards, while fostering collaboration between departments and stakeholders. This database ensures that cocoa businesses can easily access and cross-check all relevant data for EUDR and CSRD compliance.

By integrating supplier certifications (e.g., Fair Trade, Rainforest Alliance), GPS coordinates, and deforestation-free declarations, cocoa companies can meet both traceability requirements for EUDR and sustainability disclosures for CSRD.

2. Conduct Dual-Purpose Risk Assessments

Cocoa businesses should develop risk assessment frameworks that fulfill the regulatory requirements of both EUDR and CSRD.

EUDR Risk Assessments:

Under EUDR, cocoa companies need to identify regions at high risk for deforestation. This involves understanding where cocoa might be sourced from land that has been deforested. Companies should engage with farmers and suppliers to evaluate and address deforestation risks.

CSRD Risk Assessments:

For CSRD compliance, businesses must report on broader environmental impacts, including deforestation risks. Risk assessments should cover the full cocoa supply chain, evaluating both direct operations and supplier activities.

Tip: Regularly audit cocoa suppliers for deforestation compliance and integrate the results into CSRD ESG reports. Any findings of non-compliance should be included in CSRD disclosures to show how the company is managing deforestation risks.

3. Engage Suppliers Proactively

Supplier engagement is crucial to ensuring that the entire cocoa supply chain meets EUDR and CSRD requirements. For example, companies can implement supplier education programs to train farmers on sustainable farming practices, such as agroforestry and biodiversity conservation. Additionally, offering financial incentives like price premiums or access to specialized markets can encourage adherence to deforestation-free practices. Partnerships with certification bodies (e.g., Fair Trade, Rainforest Alliance) can also help align supplier operations with regulatory standards while providing verifiable proof of compliance.

Training:

Cocoa companies should educate farmers on sustainable farming practices and the importance of compliance with EUDR and CSRD. This includes training on agroforestry techniques, which involve planting cocoa alongside other trees to preserve biodiversity and prevent deforestation.

Incentives:

Offering incentives, such as price premiums or long-term contracts, can encourage farmers to adopt sustainable, deforestation-free practices. This ensures that cocoa sourcing aligns with both regulations.

Example: Large cocoa buyers like Nestlé and Lindt incentivize farmers to adopt agroforestry and sustainable farming practices, which align with both EUDR’s deforestation-free goals and CSRD’s sustainability criteria.

4. Integrate Compliance and Reporting

To ensure seamless compliance, cocoa companies should align EUDR compliance data (e.g., farm audits, geolocation data) with CSRD’s ESG reporting requirements.

Align Compliance Data:

Companies should ensure that the data collected for EUDR compliance (e.g., GPS tracking, deforestation audits) is integrated into CSRD ESG reports. This allows businesses to report on their sustainability efforts in a consistent, transparent manner.

Automation Tools:

Passionfruit automates compliance by using machine learning and integrating with tools like SharePoint or LCA platforms. It centralizes sustainability data, streamlines questionnaire responses, and performs real-time compliance checks for EUDR and CSRD. By reducing manual tasks and enhancing data accuracy, Passionfruit empowers businesses to efficiently manage regulatory requirements.

AI in Action:

Gap Analysis: Passionfruit can identify missing or incomplete data for CSRD or EUDR compliance by analyzing uploaded documents, such as policies, sustainability reports, and certifications, and cross-referencing them against regulatory requirements.

Data Matching: Passionfruit simplifies compliance by linking certification documents (e.g., Rainforest Alliance, Fair Trade) and supplier reports directly to regulatory requirements like CSRD and EUDR. This integration reduces manual data entry, ensures accurate alignment with deforestation and ESG metrics, and creates a centralized, searchable database for seamless reporting and audit readiness.

Real-World Examples

Nestlé:

Nestlé is using the CSRD and EUDR to enhance sustainability in its cocoa supply chain. Through CSRD, the company reports on its environmental and social efforts, including actions to reduce deforestation and protect biodiversity. With EUDR, Nestlé ensures that its cocoa is traceable and deforestation-free by tracking it from farm to product, aligning with the regulation’s requirements for farm-level traceability.

Nestlé’s key goals include sourcing 100% sustainable cocoa through the Nestlé Cocoa Plan, making 93.4% of its cocoa supply chains deforestation-free, and promoting regenerative farming practices. The company is also focused on improving the livelihoods of cocoa farmers, ensuring fair pricing and sustainable practices for long-term success. By integrating these regulations, Nestlé is driving both environmental and social change in the cocoa industry.

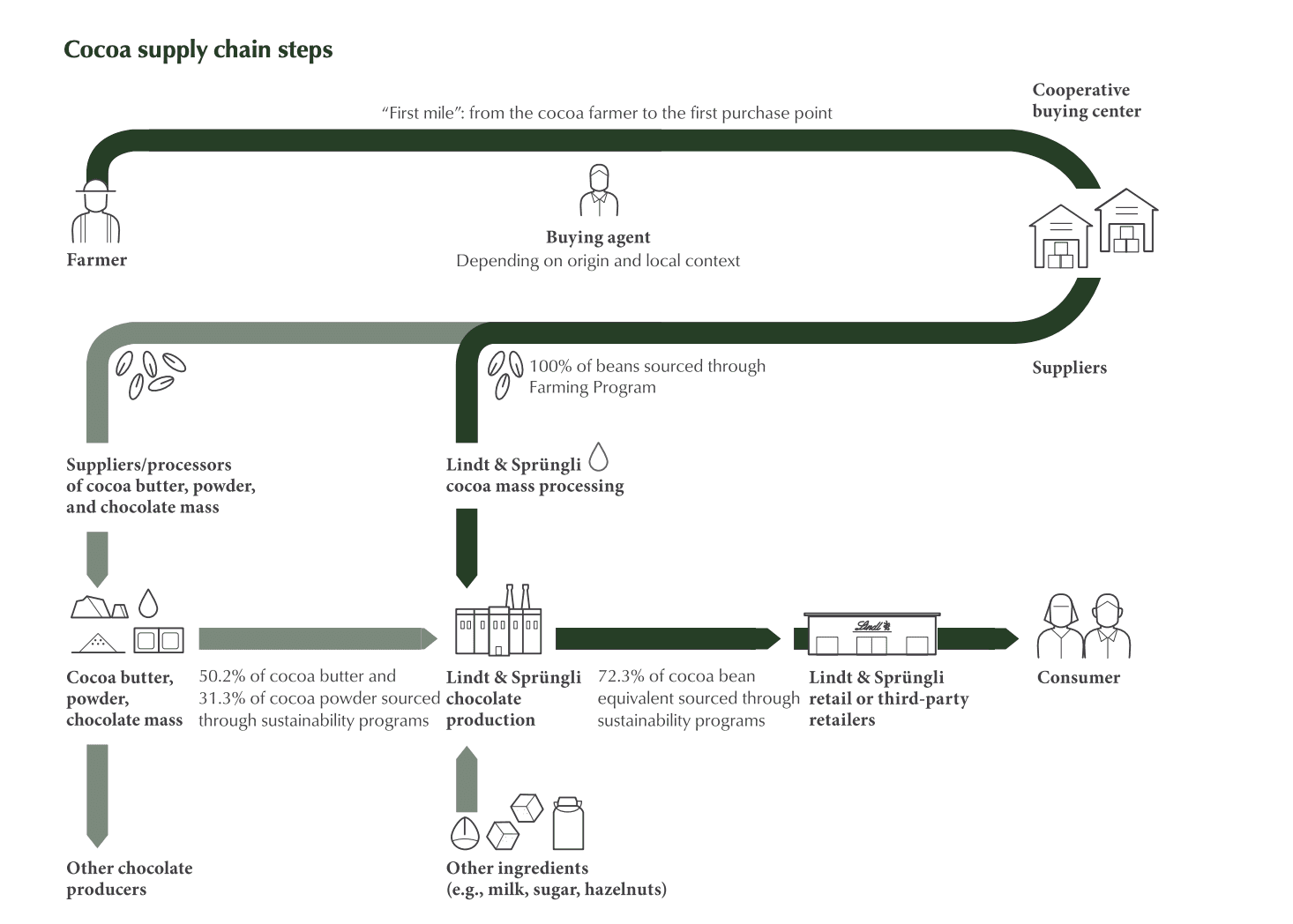

aboutLindt:

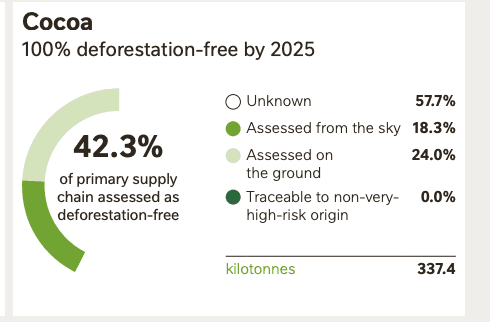

Lindt & Sprülgi is using CSRD and EUDR to ensure sustainable cocoa sourcing. CSRD helps them report on efforts to reduce deforestation and improve sustainability, while EUDR ensures their cocoa is traceable and deforestation-free.

Their goals include sourcing 100% sustainable cocoa by 2025, with 72.3% of their cocoa already meeting sustainability criteria. They have a Deforestation Policy to eliminate deforestation in their cocoa supply by 2025 and promote agroforestry practices.

Conclusion

Navigating the requirements of CSRD and EUDR can seem daunting, but coffee commodity players can turn these challenges into opportunities by adopting a proactive and integrated approach. By leveraging tools like geospatial monitoring, dual-purpose risk assessments, and supplier engagement strategies, companies can meet regulatory demands while enhancing their overall sustainability efforts.

The interplay between CSRD and EUDR highlights the need for alignment between reporting frameworks and actionable sustainability practices. Companies like Nestlé and Lindt demonstrate that with the right strategies, it’s possible to not only comply but also lead in the journey towards a more sustainable future for the coffee industry.