Thursday, April 24, 2025

How food & beverage companies are turning ESG compliance questionnaires from a burden into a strategic advantage

Maikel Fontein

Apr 24, 2025

3

min

In 2025, ESG questionnaires have become the new normal—and for food and beverage companies, that means navigating an ever-growing avalanche of forms, frameworks, and reporting requirements. From retailer surveys and investor disclosures to rigorous regulations like the CSRD, staying compliant has never been more demanding—or more complex.

But here's the good news: ESG questionnaire automation is transforming this compliance challenge into a powerful strategic advantage. In this blog, we dive into the top five trends revolutionizing ESG reporting, exploring how AI-driven platforms, centralized answer libraries, and seamless data integrations are helping food and beverage companies respond faster, smarter, and more consistently. Discover how automation not only reduces workload and errors but empowers your team to elevate ESG from a box-ticking exercise into a driver of competitive differentiation.

1. How is AI revolutionizing the way companies respond to ESG questionnaires?

AI has moved far beyond simply calculating emissions data—today, it’s actually crafting responses to ESG questionnaires for you.

Platforms like Passionfruit leverage advanced natural language processing (NLP) to transform questionnaire management:

Instant Interpretation: Automatically read and understand questions coming from any format, including portals, PDFs, Excel files, and online forms.

AI Answer Matching: Instantly pair each question with pre-approved responses from a centralized "answer library," eliminating the endless cycle of copy-pasting.

Automated Responses: Populate questionnaires with accurate answers, automatically citing relevant data sources and highlighting items that require human review.

Continuous Improvement: Learn from user feedback, becoming smarter and more accurate with every questionnaire you complete.

This powerful combination cuts down hours spent repeating the same answers, dramatically streamlines compliance processes, and ensures accuracy and consistency across all ESG disclosures.

2. Why is ESG questionnaire automation essential for regulatory compliance in 2025?

In 2025, ESG frameworks like CSRD, CDP, and GRI are setting new standards for transparency, requiring food and beverage companies to provide detailed, auditable ESG disclosures. This often translates to:

Dozens of ESG questions from each client, asking about everything from GHG emissions to water usage, diversity, and supply chain ethics.

Repetitive submission cycles that require the same data to be submitted across different frameworks and clients, time and time again.

Increased scrutiny, with penalties for inconsistencies or missing information in your responses.

In the face of these challenges, manual processes simply can’t keep up. That’s where automation comes in. By using advanced tools, companies can:

Tag questions by framework to ensure the right data is matched to the right submission.

Pull real-time data directly from ESG systems or ERPs, eliminating the need to gather the same information repeatedly.

Pre-fill responses with accurate data and generate the necessary justification text or footnotes to provide context and clarity.

Export submissions in the exact formats required by each recipient (PDF, Word, Excel, or portal-based submissions), saving time and reducing errors.

By automating the ESG questionnaire process, companies not only meet today’s regulatory demands—they position themselves for the future, creating a scalable and efficient compliance strategy that keeps up with evolving requirements.

3. How are automated questionnaires helping companies manage supplier ESG data?

Today’s retailers and regulators demand complete traceability and responsible sourcing information—not only from your own operations but also from your suppliers. Instead of managing a chaotic web of emails and chasing down documents, companies are turning to ESG questionnaire automation platforms to streamline the entire process.

These platforms enable companies to:

Distribute Supplier Self-Assessments in Bulk: Efficiently send out standardized questionnaires to all suppliers at once, saving time and ensuring consistency.

Collect Comprehensive Declarations: Gather essential information on critical topics such as deforestation, GHG emissions, labor rights, and sustainable packaging practices.

Integrate Supplier Data: Automatically link each response to a supplier profile, allowing you to flag potential risks and monitor compliance levels in real time.

Automate Reminders and Version Control: Set up automated workflows to send reminders for updates and maintain version control for recurring submissions, ensuring data remains current and accurate.

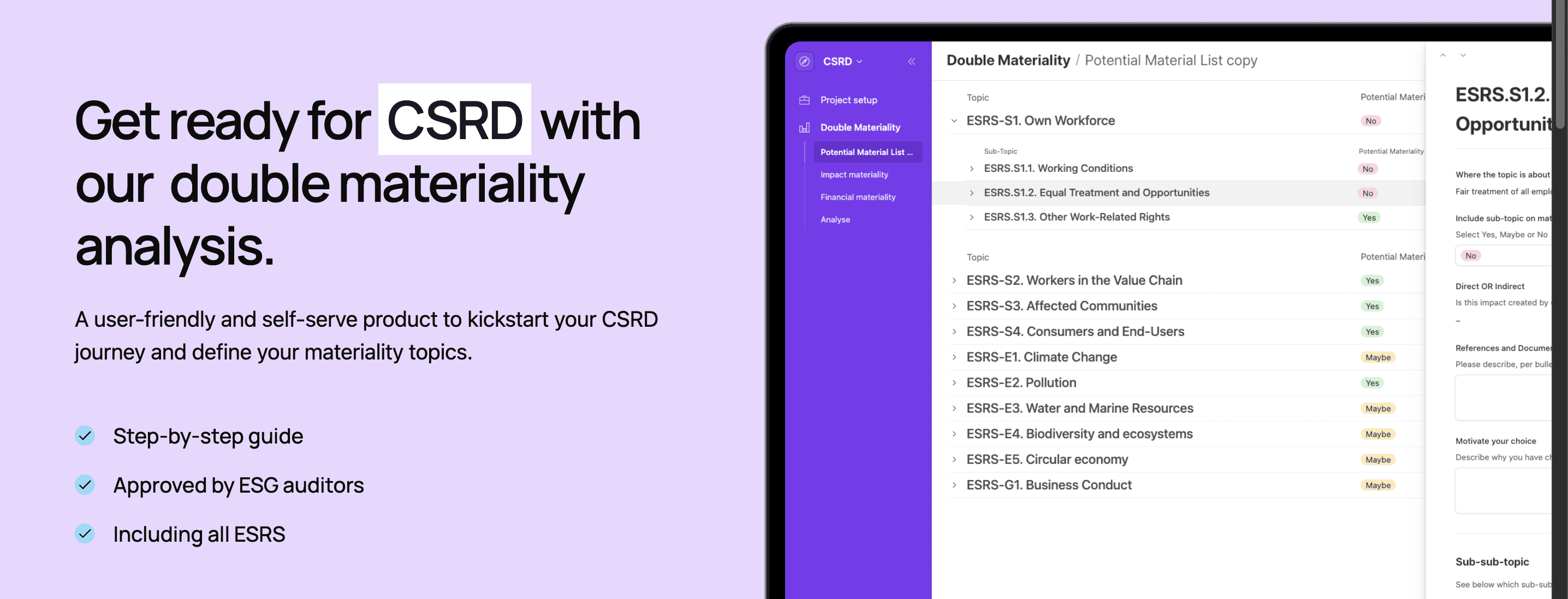

4. What does “double materiality” mean for ESG questionnaires—and how can automation help?

Double materiality requires companies to address two crucial dimensions in ESG reporting:

How ESG risks affect their business operations and financial performance

How their business activities impact the environment and society

This dual perspective adds significant complexity to ESG questionnaires. However, automation tools offer effective solutions to manage this challenge by:

Mapping Questions to Impact Themes: Align questions with key themes such as climate risk, biodiversity, and human rights, ensuring comprehensive coverage of both internal and external impacts.

Reusing Core Narratives and Data: Leverage consistent, pre-approved narratives and quantitative data across multiple reporting formats, reducing redundancy and ensuring accuracy.

Pre-Building Aligned Responses: Develop responses that simultaneously meet financial reporting and ESG standards, ensuring cohesive and compliant disclosures.

Facilitating Stakeholder Collaboration: Integrate built-in approval workflows that involve finance, legal, and sustainability teams, ensuring that all perspectives are considered and validated.

By automating these processes, companies can handle the intricate demands of double materiality without becoming overwhelmed, maintaining both precision and efficiency in their ESG reporting.

Tip: Using Passionfruit double materiality assessment can help you get started on ESG factors that truly matter

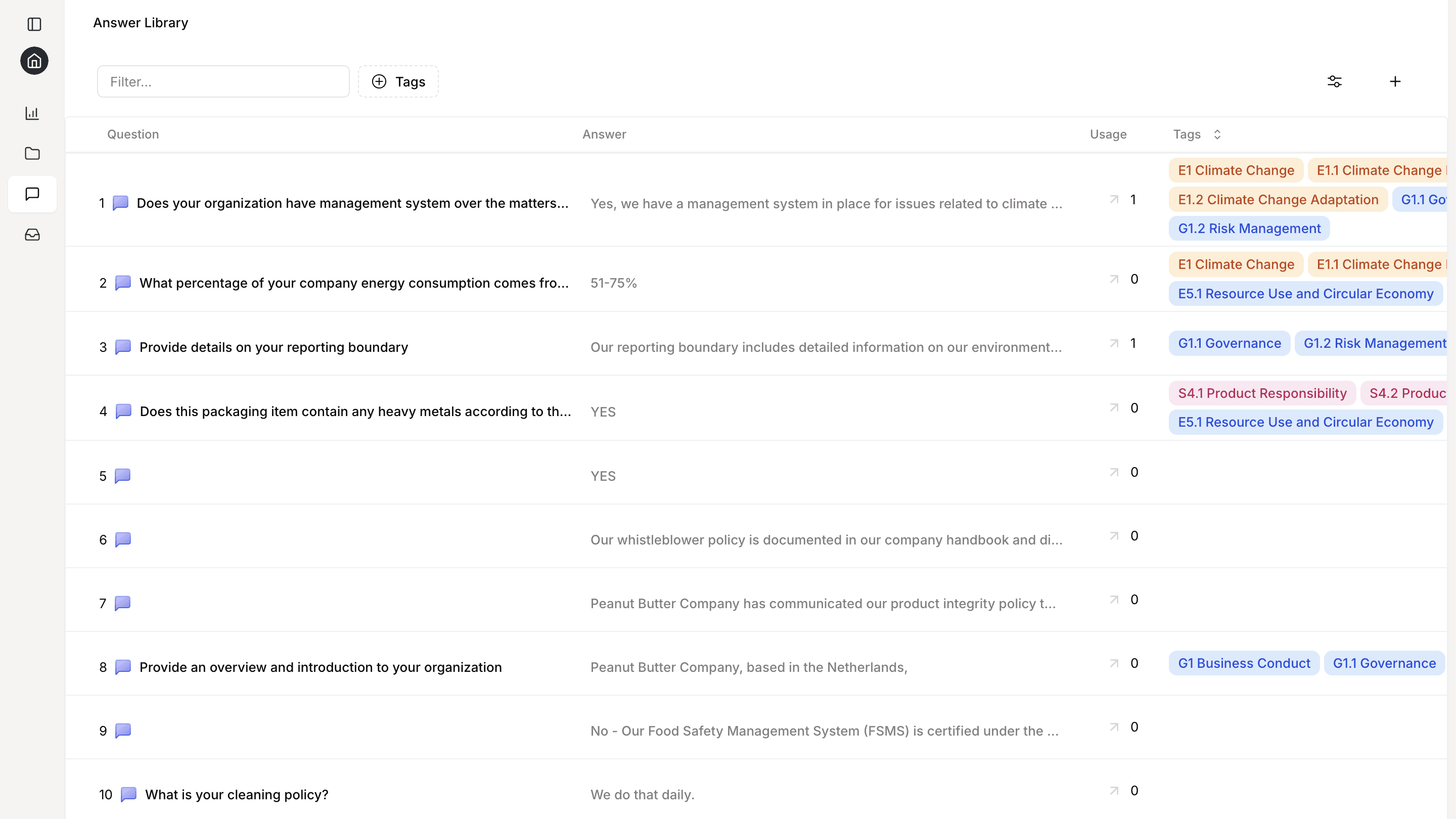

5. Can shared answer libraries and APIs finally end ESG questionnaire fatigue?

Absolutely—and we’re already witnessing the transformation in action.

Many companies are now investing in central ESG knowledge hubs to store pre-approved, reviewer-vetted answers for recurring questionnaire topics. These centralized libraries serve as a single source of truth, which not only boosts consistency but also significantly cuts down the manual work required for each new submission. Here’s how they add depth to your ESG reporting process:

Auto-Populate New Forms: Instead of starting from scratch with every questionnaire, these libraries instantly fill in recurring answers, ensuring that submissions are both quick and reliable.

Ensure Consistency and Accuracy: With a unified repository, every response is drawn from pre-approved data. This minimizes the risk of human error and maintains consistent messaging across different frameworks and reporting cycles.

Continuous Improvement: By learning from historical responses, the system refines its suggestions over time. This adaptive quality means that each new submission can be even more precise and tailored than the last.

Multi-Language and Format Support: Whether you’re submitting to CDP portals, EcoVadis, or retailer audit systems, the system adapts the output to meet specific language and format requirements, ensuring compliance regardless of the submission channel.

In addition to these features, API integrations play a critical role. They enable seamless data flow between your ESG knowledge hub and key platforms, such as:

CDP Portals

Retailer Audit Systems

CSRD Tagging Tools (e.g., XBRL)

These integrations ensure that updates in your central library are automatically reflected across all connected systems, eliminating redundant work and ensuring real-time accuracy. This “answer once, share everywhere” model drastically reduces the operational friction typically associated with ESG reporting, making it far easier to manage increasing volumes of data with growing regulatory scrutiny.

The Bottom Line: Is ESG questionnaire automation a nice-to-have—or a necessity?

In 2025, ESG reporting has evolved from a compliance checkbox into a strategic imperative that requires precision, speed, and consistency. Food and beverage companies are contending with:

Escalating Volumes: With a growing number of ESG questionnaires to answer, manual processes simply can’t keep pace.

Stricter Deadlines: Rapidly approaching regulatory and client-imposed timelines demand a more agile response.

Resource Limitations: Limited staff must now manage a complex, ever-expanding array of compliance requirements.

ESG questionnaire automation isn’t just an operational upgrade—it’s a strategic necessity.

Platforms like Passionfruit harness advanced NLP, centralized answer libraries, and robust API integrations to automate up your ESG questionnaires. This comprehensive automation solution allows you to scale your reporting efforts without sacrificing accuracy or overburdening your team. The result? A streamlined, efficient ESG process that turns compliance challenges into a competitive advantage, freeing up valuable resources to focus on strategic growth.