Monday, October 28, 2024

ESG and sustainability are often used interchangeably, but they're distinct concepts. This blog post breaks down the differences, explores their significance in the food industry, and offers actionable insights for sustainability managers.

Maikel Fontein

Oct 28, 2024

5

min

Learn the key differences between ESG and sustainability, and why it matters for the food & beverage industry

The terms Sustainability and ESG (Environmental, Social, Governance) are often used interchangeably, but they represent different concepts. For sustainability managers, understanding these differences is crucial because mixing them up can lead to missed opportunities or misdirected efforts. This blog will break down what ESG is, how it differs from sustainability, and why the distinction is important—particularly for companies active in complex supply chains, like the food industry.

What is ESG?

ESG originally emerged as a financial instrument, used by investors to evaluate the long-term risks and opportunities associated with a company. It helps assess whether a company is responsibly managing its environmental impact, social responsibilities, and corporate governance practices.

Evolution of ESG as a Business Tool

In recent years, ESG has evolved beyond the investor sphere. Companies are using ESG to benchmark themselves against competitors, ensure they meet compliance standards, and improve their public image. ESG reporting has thus become an essential tool for sustainability managers and businesses seeking to demonstrate transparency and accountability.

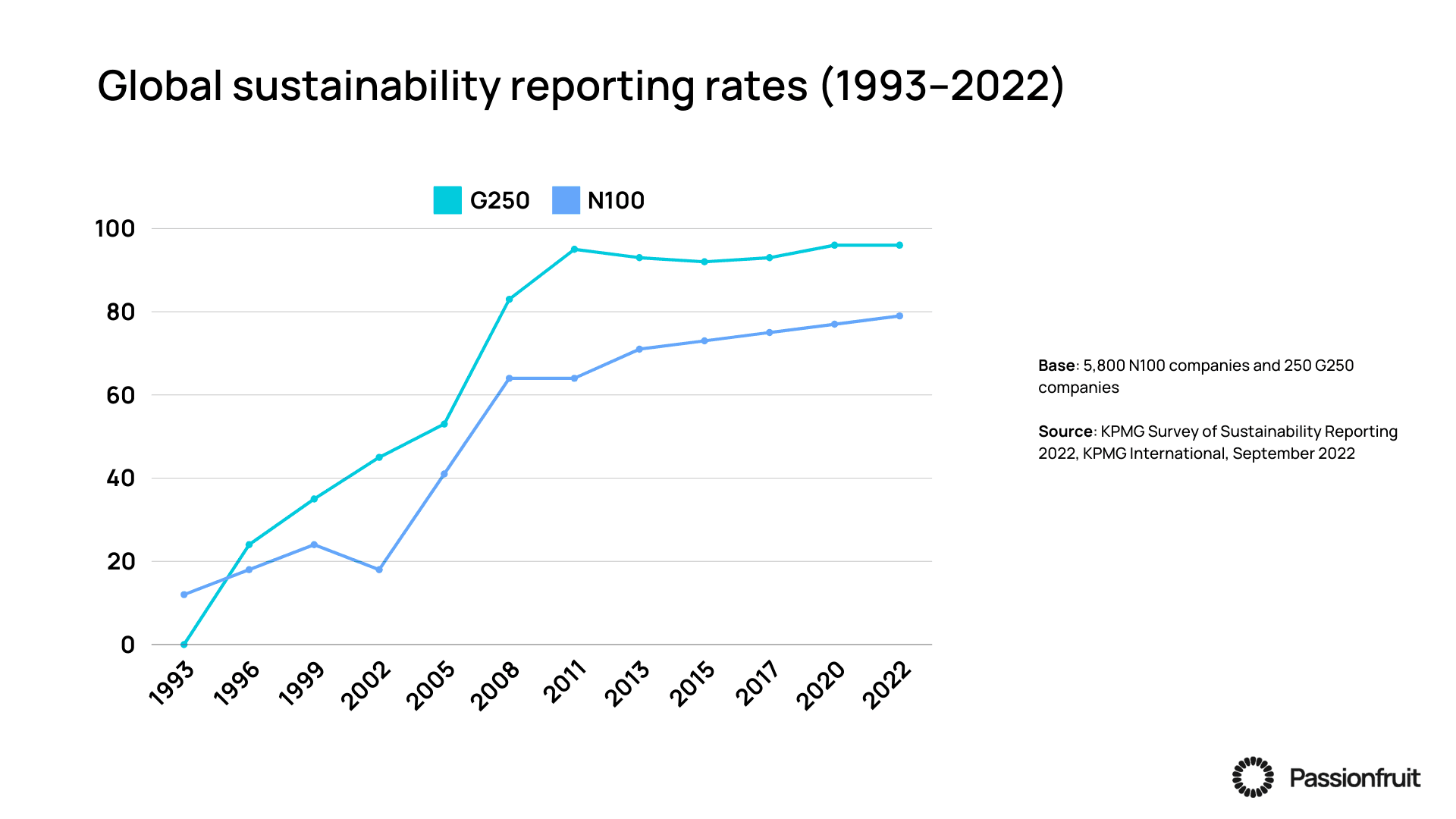

The picture bellow provides a perfect example. The Global sustainability reporting rates shows many companies have disclosed their environmental, social, and governance (ESG) performance.

N100: Largest 100 companies by revenue in each of 49 countries researched in this study

G250: Top 250 companies globally by revenue.

Historical Context: The Roots of ESG

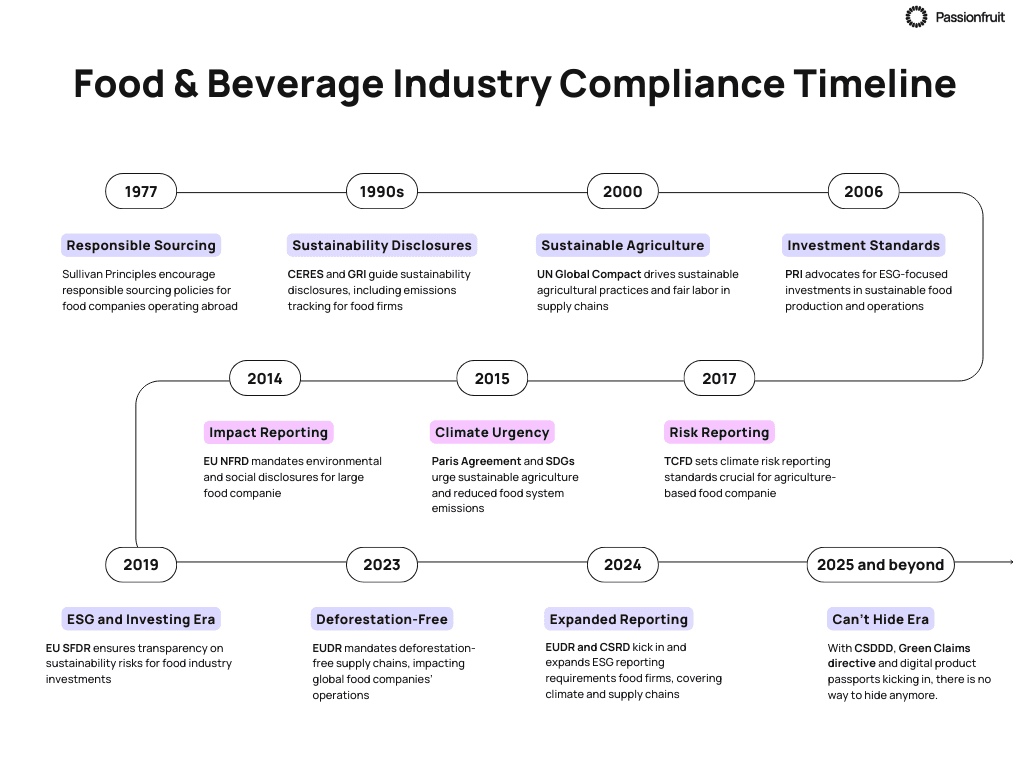

The ESG concept gained traction in the early 2000s with the UN Principles for Responsible Investment (PRI) in 2006, prompting institutions to integrate ESG factors into their analyses. Frameworks like the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) soon followed, setting standards for corporate transparency.

The Shift Towards Regulation

Growing awareness of climate change and social issues led to stricter regulations. The Paris Agreement in 2015 highlighted sustainability’s urgency, while the EU introduced the Taxonomy Regulation and Sustainable Finance Disclosure Regulation (SFDR), requiring businesses to disclose their sustainability impacts.

Benchmarking and Competitive Advantage

Today, ESG is vital for companies aiming to benchmark against competitors and drive operational improvements. Businesses view ESG reporting as a strategic tool for innovation and risk management rather than just compliance.

What is Sustainability?

Sustainability is a holistic approach to business operations that aims to meet present needs without compromising the ability of future generations to meet their own. It involves balancing environmental, social, and economic considerations to ensure long-term viability and resilience.

Sustainability is about meeting present needs without compromising the future. It involves balancing environmental, social, and economic factors. Think of it as a long-term commitment to responsible business practices.

On the other hand, ESG (Environmental, Social, and Governance) provides a framework for measuring and reporting on sustainability initiatives. It helps companies track their progress in areas like reducing their carbon footprint, promoting ethical sourcing, and ensuring fair labor practices.

A sustainable food company might focus on sourcing ingredients responsibly, reducing waste, and conserving resources. ESG reporting would then be used to track and communicate these efforts to stakeholders, investors, and consumers. Essentially, you can be sustainable without having a high ESG score, but ESG helps you measure and demonstrate your sustainability performance.

Similarities and Differences between ESG and Sustainability

While both ESG and sustainability share a concern for environmental, social, and governance factors, their core focus and application differ significantly:

1. Purpose

Sustainability: Sustainability: Think of sustainability as a long-term game plan for doing good. For food companies, this might mean implementing strategies to reduce carbon footprints by optimizing transportation routes or switching to renewable energy sources in their production facilities. It's also about protecting biodiversity, like a dairy farm using integrated pest management to minimize chemical usage while supporting local wildlife. And let's not forget fair labor practices, where a chocolate brand ensures that cocoa farmers receive fair wages and work in safe conditions.

ESG: Now, ESG is like the report card for those sustainability efforts. It’s all about assessing and measuring how well a company is doing in these areas. For instance, a food manufacturer might track metrics like water usage or waste generation, compiling this data into a score that reflects their environmental, social, and governance practices. This score isn’t just for show; stakeholders, investors, and regulators use it to decide whether a company is a good citizen of the world. Imagine a restaurant chain that documents its efforts to source local ingredients and reduce food waste—this data can boost their ESG score, making them more attractive to conscious consumers and investors alike.

2. Measurement and Reporting

Sustainability initiatives often lack standardised metrics, which can make it challenging to compare performance across companies or industries. ESG fills this gap by offering structured reporting formats and indicators. For example:

The Sustainability Accounting Standards Board (SASB) has set up 77 industry-specific standards. For food and beverage companies, this means tracking metrics like greenhouse gas (GHG) emissions, water usage, and human rights impacts. These standards help companies measure and communicate their sustainability initiatives more effectively.. Explore the SASB framework

The Task Force on Climate-related Financial Disclosures (TCFD), initiated by the Financial Stability Board, focuses on how companies handle climate-related risks. This framework encourages food companies to disclose strategies for sourcing ingredients from climate-resilient regions, ensuring they can adapt to changing weather patterns. Sourcing ingredients from areas less affected by climate change demonstrates to investors a proactive approach to sustainability and long-term viability. Discover the TCFD recommendations

3. Regulation and Frameworks

While sustainability is driven by principles and long-term goals, ESG is increasingly regulated to ensure companies maintain consistent standards. For example:

The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates food companies to report on ESG metrics, focusing on their environmental and social impact. For example, disclosing sustainable sourcing and water management practices is crucial. Non-compliance can result in significant fines and reputational damage, emphasizing the need for transparency and sustainable practices in the food industry.

The European Union Deforestation Regulation (EUDR) promotes sustainable supply chains. It encourages practices like sourcing deforestation-free commodities and ensuring traceability to protect forests. By embracing this regulation, food companies demonstrate their commitment to protecting biodiversity and contributing to a more sustainable future.

Common Misconceptions about ESG

One dangerous misconception is that a high ESG score automatically equals true sustainability. This is false. A company can master the art of ESG reporting without genuinely embedding sustainable practices into its core operations. This is often referred to as "greenwashing" – presenting a facade of environmental responsibility without the substance. Imagine a cereal company that splashes images of happy farmers on their boxes and talks about sustainable sourcing, but uses palm oil from deforested areas in its ingredients. They create a wholesome image while contributing to environmental damage. Conversely, a company can be deeply committed to sustainability but score poorly on ESG due to inadequate reporting, a lack of standardized metrics, or simply not prioritizing the reporting aspect of their efforts.

Practical Examples from the Food Industry

Lets step out from the theoretical and give more concrete examples, to better illustrate these concepts

The Local Farm: Think of a small farm near your town that grows organic fruits and vegetables. They treat their workers fairly, use natural pest control methods, and avoid unnecessary packaging. They're doing lots of good things for the environment and their community, but they might not have the time or resources to fill out complicated ESG reports. This shows they can be sustainable without having a top-notch ESG score.

The Big Food Company: Imagine a huge company that makes snacks. They brag about using recycled packaging and solar energy in their factories. But, they get their ingredients from farms that use harmful chemicals and don't pay their workers well. This company looks good on paper with a high ESG score, but they aren't truly sustainable because they harm the environment and people in their supply chain.

The Fish Company: Now, think about a company that catches fish. They make sure not to overfish, protect the ocean, and treat their fishermen fairly. They also share a detailed report about how they're doing good things for the planet and society. This company shows that it's possible to be both truly sustainable and have a great ESG score that proves it.

These examples highlight the critical distinction between ESG and sustainability. ESG is a valuable tool for measuring and reporting progress, but it's not the be-all and end-all. True sustainability requires a holistic approach, embedding responsible practices into every facet of the business.

Actionable Insights for Sustainability Managers

For sustainability managers, grasping the nuances of ESG and sustainability is paramount for developing and implementing impactful strategies. This involves:

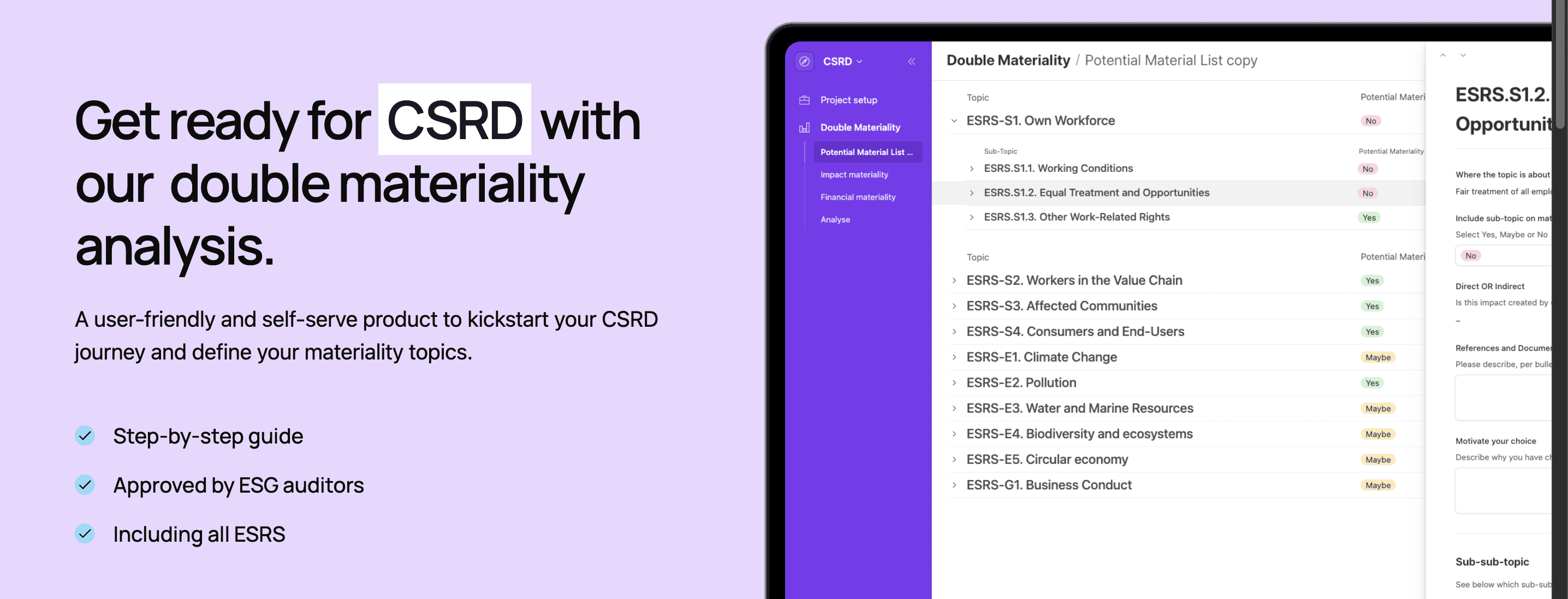

Identifying Material ESG Metrics: Don't just gather data—prioritize! Use a materiality assessment to identify the ESG factors that truly matter to your business, investors, and stakeholders. This will vary significantly depending on your industry, location, and business model. For example, a food company might focus on sustainable sourcing and waste reduction, while a retailer might prioritize supply chain labor practices and ethical sourcing.

Tip: Using Passionfruit double materiality assessment can help you get started on ESG factors that truly matter

Developing Robust Sustainability Initiatives: Developing robust sustainability initiatives requires translating ESG metrics into tangible action and embedding sustainability into your core business strategy. For example, if your materiality assessment reveals water scarcity as a key issue, you might invest in water-efficient technologies, implement rainwater harvesting systems, and engage with local communities on water conservation. Prioritize initiatives that address your most material ESG issues and contribute to your overall business goals.

Integrating ESG Reporting into Sustainability Strategies: Use ESG reporting to drive performance, transparency, and accountability. Integrate ESG metrics into your performance management systems. Establish clear targets and timelines for improvement. Regularly monitor and evaluate your progress, and transparently disclose your results, both positive and negative.

Staying Ahead of the Curve: The ESG landscape is constantly evolving, so staying ahead of the curve is crucial. Make time to keep abreast of new regulations, reporting standards, and emerging best practices. This might involve subscribing to industry newsletters or attending relevant conferences. By proactively monitoring these changes, you can ensure your sustainability strategies remain relevant and effective.

Conclusion

ESG is a reporting tool for certain aspects of sustainability, which is a broader commitment to responsible business. Essentially, ESG measures; sustainability acts. Don’t mistake a high ESG score for true sustainability.