Thursday, October 31, 2024

This guide covers the European Sustainability Reporting Standards (ESRS) 1 and 2, emphasizing compliance with the CSRD. It provides practical tips and examples for effective ESG reporting to enhance transparency and performance.

Maikel Fontein

Oct 31, 2024

7

min

The European Sustainability Reporting Standards (ESRS), established under Directive (EU) 2022/2464—the EU’s Corporate Sustainability Reporting Directive (CSRD)—provide essential guidelines for consistent and transparent reporting on environmental, social, and governance (ESG) impacts. Developed by the European Financial Reporting Advisory Group (EFRAG), these standards aim to create a unified framework enabling companies to communicate their sustainability efforts effectively. With ESRS 1 and ESRS 2 as foundational standards, organizations receive clear requirements and disclosures to ensure that their sustainability data is meaningful, verifiable, and aligned with stakeholder expectations across sectors.

This guide will break down ESRS 1 and ESRS 2, offering practical advice and examples from the food industry to support companies in achieving compliance.

Why ESRS Compliance Matters for Food Companies

Complying with ESRS standards is more than a legal obligation for food companies; it’s an essential step towards improving industry transparency and aligning with investor priorities. Adherence to ESRS standards, particularly ESRS 1 (General Requirements) and ESRS 2 (General Disclosures), not only enhances a company’s ESG standing but also addresses stakeholders' increasing demand for accountability. Transparency in ESG practices improves a company’s reputation, builds consumer trust, and can even facilitate easier access to capital, as investors prioritize sustainable operations.

Compliance with ESRS further supports proactive risk management, enabling companies to identify and mitigate potential threats associated with supply chain disruptions, resource scarcity, and environmental regulations. For instance, in the food sector, climate change and water scarcity present significant risks, which ESRS 1 and 2 guide companies to address through comprehensive ESG planning.

ESRS 1: The Basics of General Requirements

Understanding the Categories and Reporting Areas

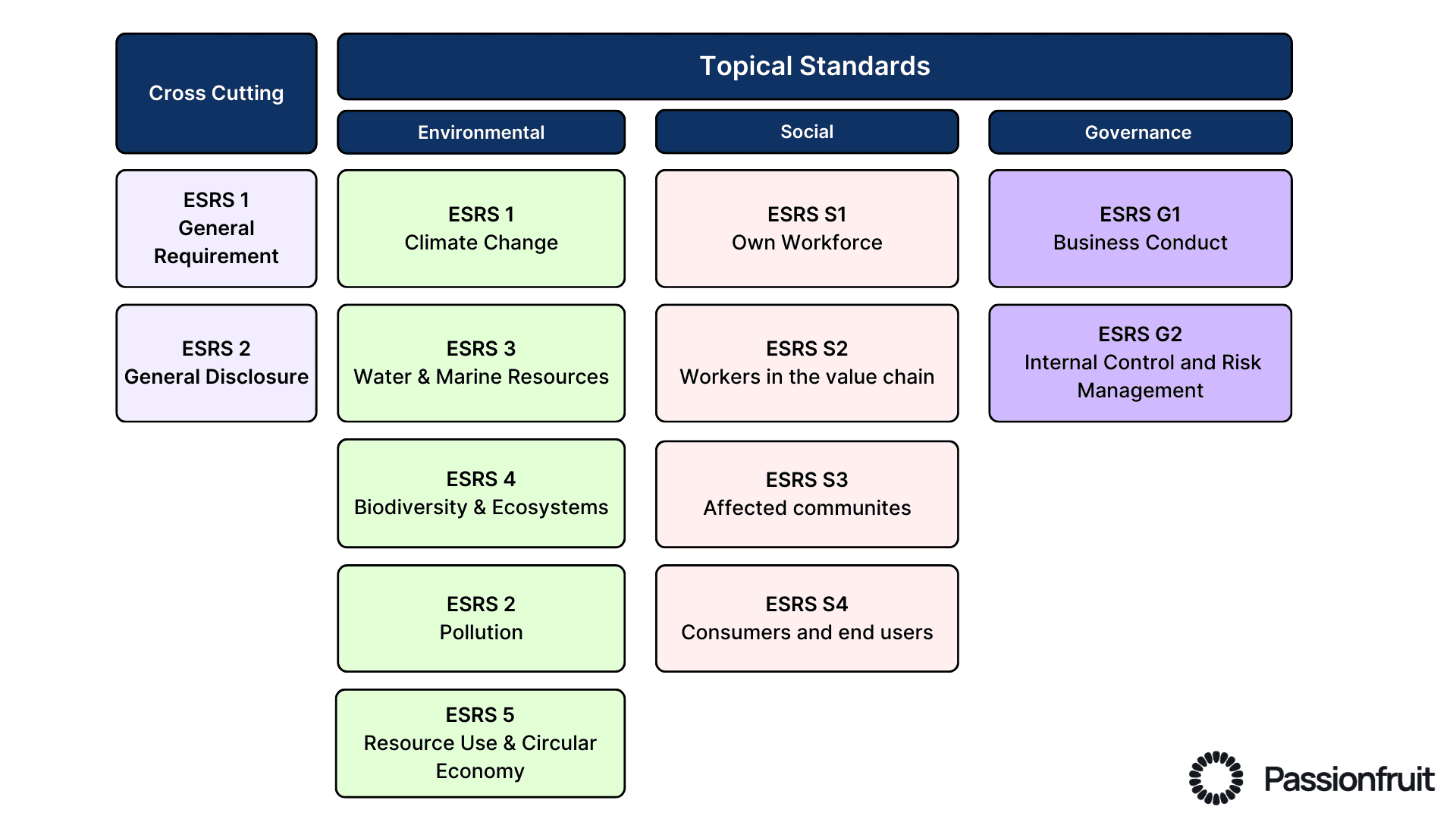

ESRS 1 divides reporting standards into three categories:

Cross-Cutting Standards: These apply universally across all sectors, providing a foundation for sustainability reporting. This category includes overarching principles that guide all reporting, such as the need for stakeholder engagement and transparency.

Topical Standards: Organized by environmental, social, and governance themes, these standards delve into specific aspects of ESG reporting. For instance, food companies may encounter standards focused on resource use (water, energy), waste management, labor practices, and community engagement.

Sector-Specific Standards: These address impacts unique to certain industries. For example, a food processing company would follow the general requirements in ESRS 1 and 2 while also referencing sector-specific standards detailing sustainability impacts relevant to food production, such as energy efficiency in processing plants or sustainable sourcing of ingredients.

Tip: Begin by understanding and implementing cross-cutting and topical standards while preparing for future sector-specific standards to address industry-specific requirements.

Prioritizing Information Quality

Under Article 19, ESRS 1 emphasizes that sustainability information must be:

Relevant: Must be meaningful for stakeholders. For example, food companies should focus on the environmental impact of their sourcing practices, such as the carbon footprint of transporting ingredients.

Comparable: This allows year-over-year tracking and benchmarking. Companies should establish a consistent methodology for reporting metrics like energy consumption, enabling comparisons over time.

Verifiable: Must be accurate and based on reliable data. For instance, if a food manufacturer reports on water usage, it should present data in a way that allows stakeholders to track progress in water-saving efforts over time.

Understandable: Clearly presented, without excessive technicality. Use clear language and visuals to convey sustainability efforts, making reports accessible to a broad audience.

Practical Step: Establish consistent data collection processes and internal checks to ensure information is accurate, documented, and easily comparable.

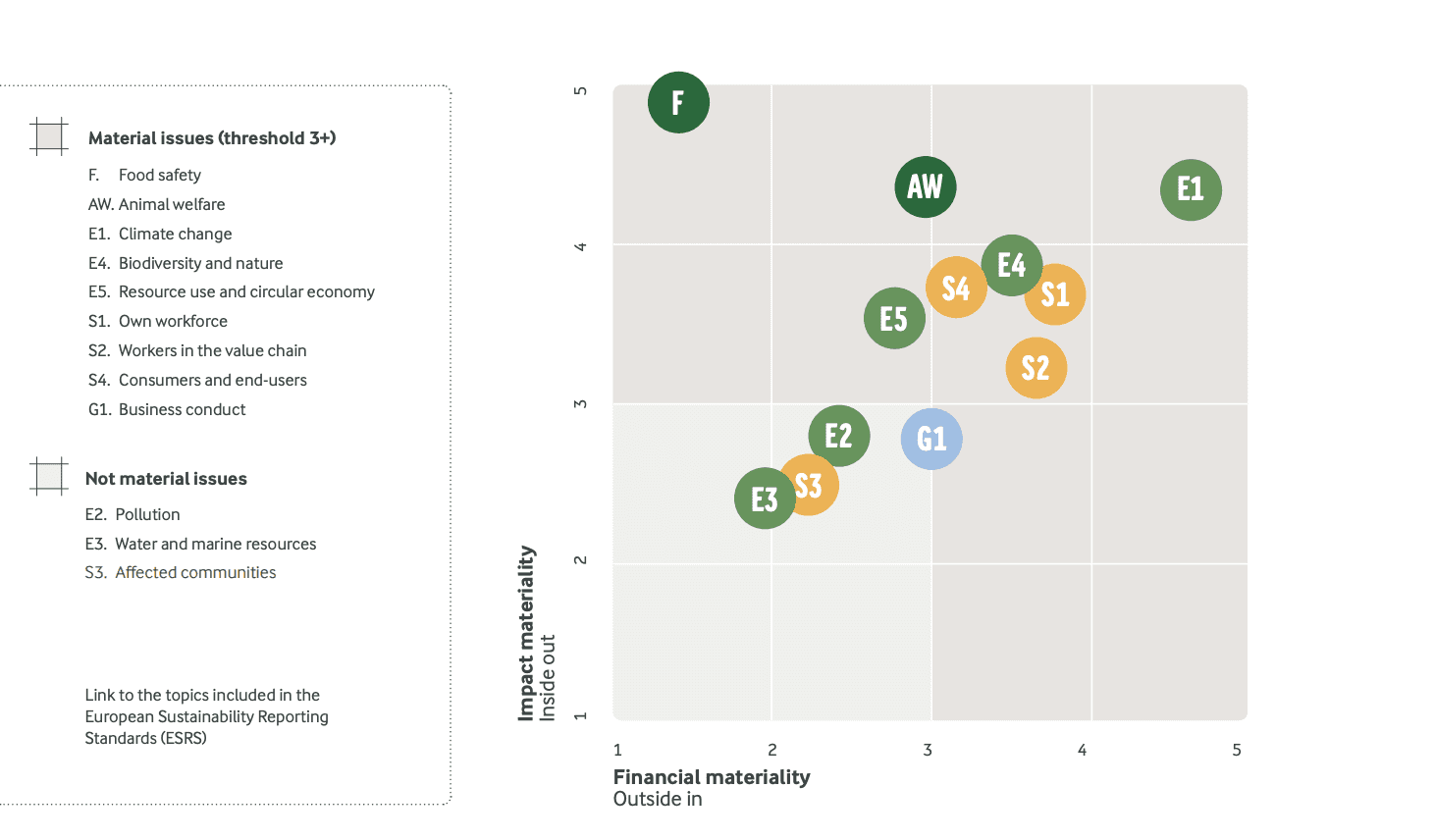

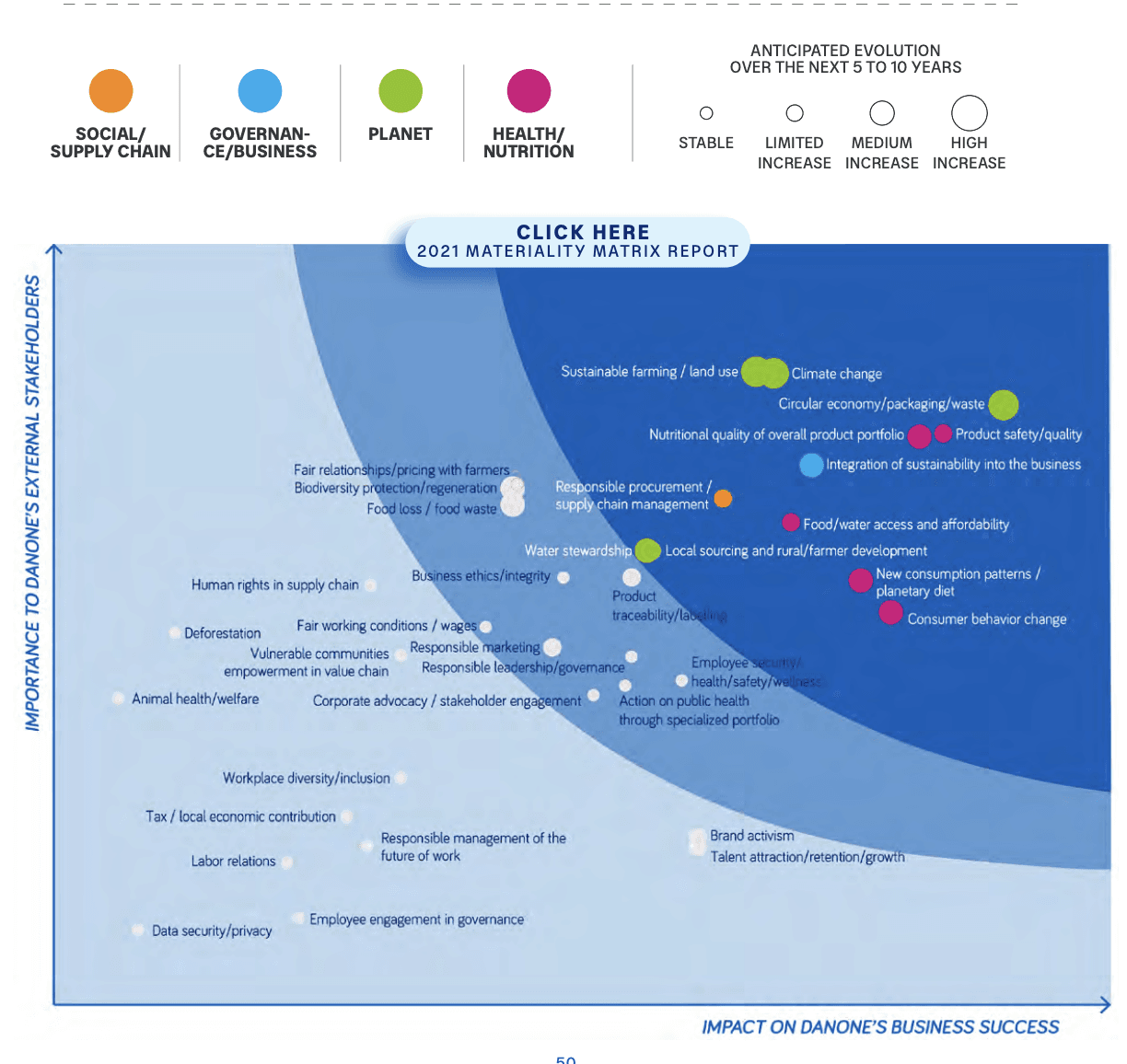

The Principle of Double Materiality

Double materiality combines two perspectives:

Impact Materiality: How the company’s actions affect society and the environment. For instance, a food company's decision to use palm oil may have implications for deforestation and biodiversity loss.

Financial Materiality: How sustainability factors impact the company’s finances. For example, how water scarcity could increase production costs for a food manufacturer sourcing from water-stressed regions.

Tip: Integrate double materiality assessments into the reporting strategy by engaging a broad range of stakeholders to better understand impacts and dependencies. This holistic view ensures that both internal and external impacts are addressed.

To streamline this assessment process, Passionfruit’s double materiality tool provides targeted insights that help companies identify and manage both impact and financial materiality. Learn more about it here.

Real-World Examples of Double Materiality Assessments

For companies wanting to get a head start with their double materiality. Passionfruit’s double materiality tool simplifies the process to help define topics and kickstart your CSRD journey.

Due Diligence in the Value Chain

ESRS 1, Articles 58-61, mandates that companies manage sustainability impacts along their entire value chain, from suppliers to end-users. This due diligence process, aligned with the UN Guiding Principles on Business and Human Rights, requires considering upstream and downstream effects.

For instance, a food company sourcing cocoa or palm oil must assess and mitigate risks such as deforestation or unfair labor practices. This may involve regular supplier audits or working exclusively with certified suppliers.

Advice for Companies:

Partner with transparent suppliers: Ensure that suppliers adhere to sustainability standards and practices.

Conduct regular assessments: Verify that suppliers meet ESG criteria through audits and evaluations.

Set up a protocol: Develop procedures to evaluate and support suppliers in achieving sustainability goals.

ESRS 2: Fulfilling the General Disclosures

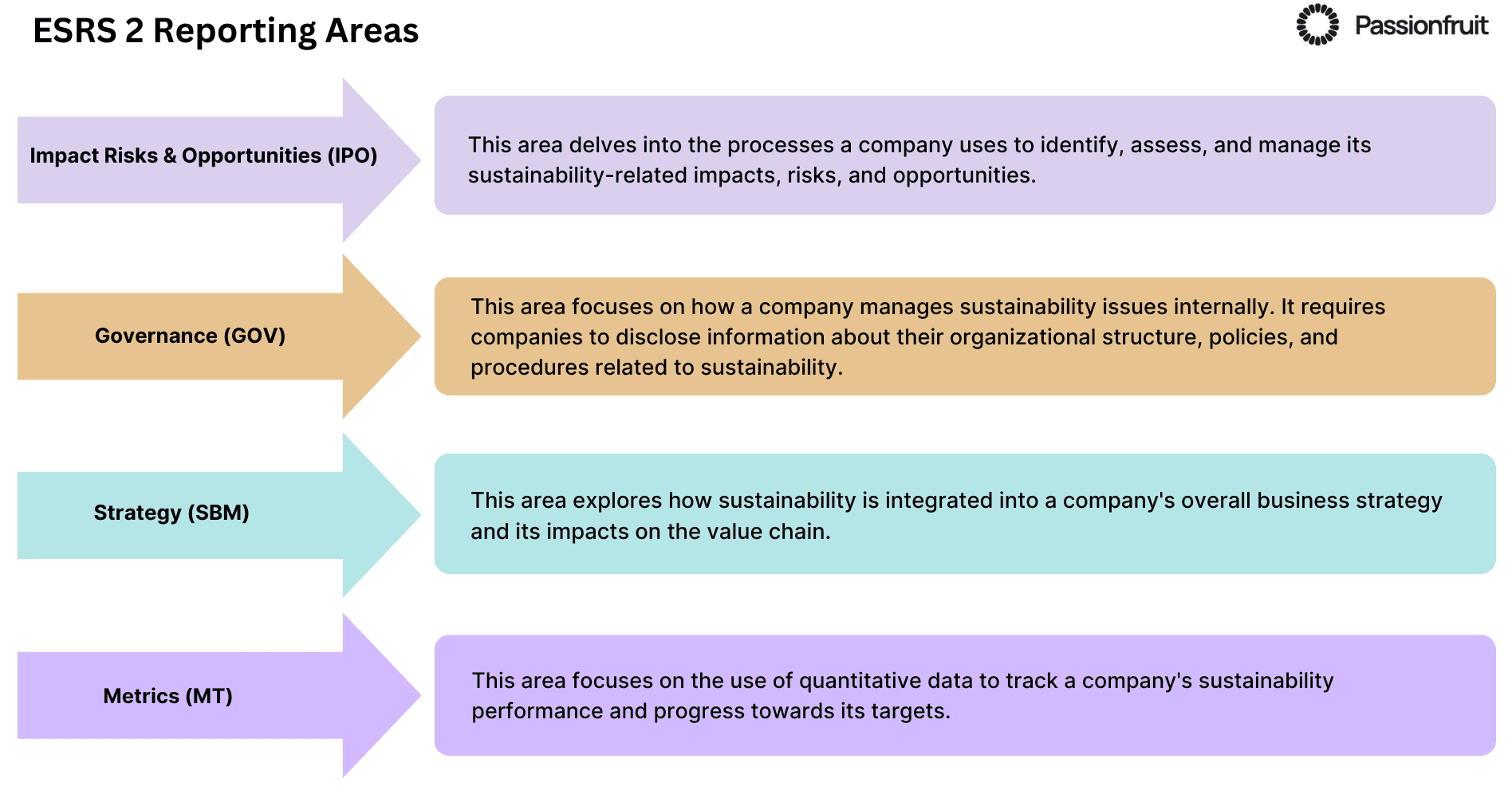

At the heart of ESRS 2 are structured requirements that guide companies in providing transparent and organized disclosures on their sustainability practices. This standard’s framework centers around four core components: Impact, Risk, and Opportunity Management (IRO); Governance (GOV); Strategy (SBM); and Metrics and Targets (MT).

1. Impact, Risk, and Opportunity Management (IRO)

IRO serves as the foundation for identifying, assessing, and managing an organization’s material impacts, risks, and opportunities. This component ensures that sustainability considerations are integrated into core business processes, allowing companies to proactively address potential challenges and capitalize on emerging opportunities.

Key Disclosure Requirements:

IRO-1: Organizations must describe the processes they employ to identify and assess material impacts, risks, and opportunities. This can involve systematic assessments, such as Environmental Impact Assessments (EIAs), that evaluate how a company’s operations affect the environment and communities. For example, a food manufacturer might conduct an EIA to understand the water usage and waste generated during production, enabling them to implement more sustainable practices.

IRO-2: Transparency is vital, requiring organizations to clarify which sustainability matters are covered by their sustainability statement. This may include disclosures on greenhouse gas emissions, resource consumption, and social impacts, ensuring stakeholders understand the scope of the company’s commitments.

Minimum Disclosure Requirements (MDR):

Policies (MDR-P): Documenting adopted policies to manage material sustainability matters is essential for demonstrating accountability. For instance, a company may establish a zero-waste policy aimed at minimizing waste generation throughout its operations.

Actions (MDR-A): Detailing the actions taken and resources allocated toward sustainability initiatives shows commitment and proactive management. For example, a beverage company could outline its investments in energy-efficient equipment and renewable energy sources to reduce its carbon footprint.

Practical Tip: Engage stakeholders regularly to gather insights on potential risks and opportunities. Tools like surveys and workshops can facilitate meaningful discussions. For instance, a food processing company might host workshops with suppliers to identify best practices in sourcing sustainable ingredients, fostering collaboration and innovation.

2. Governance (GOV)

GOV outlines the processes and controls organizations use to monitor and manage sustainability impacts, risks, and opportunities, emphasizing the importance of accountability in governance structures. Effective governance ensures that sustainability considerations are embedded in the decision-making processes at all levels of the organization.

Key Disclosure Requirements:

GOV-1: Organizations must define the roles of their administrative, management, and supervisory bodies in overseeing sustainability efforts. This may involve appointing a Chief Sustainability Officer (CSO) who reports directly to the board, ensuring sustainability is prioritized in strategic discussions.

GOV-2: Disclosing information on sustainability matters addressed by governance bodies highlights the integration of sustainability into decision-making. For example, a company might provide insights into board meetings that focused on climate risk assessments and sustainability strategy development.

GOV-3: Companies should describe how sustainability-related performance is integrated into executive compensation, ensuring alignment with organizational goals. For instance, linking a portion of bonuses to achieving sustainability targets can motivate leadership to prioritize ESG initiatives.

Minimum Disclosure Requirements:

GOV-4: A statement on due diligence processes demonstrates a commitment to ethical practices. For example, a food retailer could disclose its efforts in ensuring suppliers adhere to fair labor practices and environmental standards.

GOV-5: Outlining risk management and internal control mechanisms over sustainability reporting ensures data integrity. This may include establishing audit processes to verify sustainability claims made in reports.

Practical Tip: Establish a dedicated sustainability committee at the board level to enhance oversight of ESG initiatives and ensure effective governance. Such a committee can regularly review sustainability performance and recommend actions to align business practices with strategic sustainability goals.

3. Strategy (SBM)

SBM focuses on the interaction between an organization’s business model, strategy, and material impacts, risks, and opportunities. It highlights the importance of integrating sustainability into the overall strategic framework, enabling companies to align their operational objectives with societal expectations.

Key Disclosure Requirements:

SBM-1: Companies must describe their overall strategy and business model, detailing how sustainability impacts are incorporated into the value chain. For example, a meat processing company may outline how it integrates animal welfare considerations into its sourcing and production processes, ensuring ethical treatment of livestock.

SBM-2: Incorporating stakeholder interests in strategic planning is vital for aligning with societal expectations. This could involve conducting stakeholder consultations to gather feedback on sustainability initiatives, ensuring that the strategy reflects the views of customers, employees, and community members.

SBM-3: Discussing material impacts, risks, and opportunities relevant to the business strategy provides insight into decision-making processes. A snack food manufacturer might identify rising consumer demand for plant-based alternatives as an opportunity, leading to the development of new product lines that align with sustainability goals.

Practical Tip: Conduct scenario analyses to understand how potential risks and opportunities may impact the business model, enabling strategic adjustments as needed. For instance, a dairy company could evaluate the implications of climate change on milk supply and explore alternatives, such as plant-based dairy substitutes, to diversify its offerings.

4. Metrics and Targets (MT)

MT emphasizes how organizations measure performance and track progress toward sustainability goals and targets. Establishing clear metrics is essential for demonstrating accountability and fostering continuous improvement, ensuring that organizations can transparently report on their sustainability journey.

Minimum Disclosure Requirements (MDR):

Metrics (MDR-M): Companies must define metrics related to material sustainability matters, encompassing both quantitative and qualitative data. For instance, a bakery might track metrics such as waste generation per product unit and water usage per batch, enabling more precise assessments of resource efficiency.

Targets (MDR-T): Organizations should establish specific targets to evaluate the effectiveness of their policies and actions. For example, a beverage company may set a target to reduce plastic packaging by 50% within five years, providing a clear benchmark for progress.

Practical Tip: Create a sustainability performance dashboard to consolidate key metrics, making it easier for stakeholders to track progress and ensure accountability. A grocery chain might use such a dashboard to display energy consumption, waste reduction achievements, and community engagement initiatives, fostering transparency and encouraging customer involvement.

Conclusion

By actively engaging with the ESRS framework, food companies can comply with regulatory standards and enhance their sustainability practices, foster stronger relationships with stakeholders, and contribute positively to the environment and society. Embracing these standards positions companies as leaders in sustainability, ultimately benefiting their bottom line and the planet.